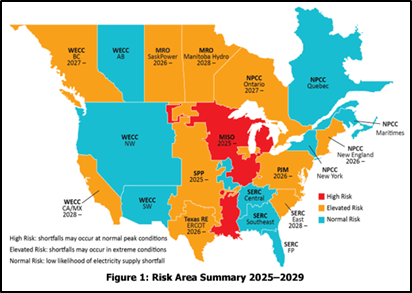

The North American Electric Reliability Corporation (NERC) 2024 Long-Term Reliability Assessment (LTRA) warns of rising grid reliability risks as the energy landscape shifts, with 122,000 megawatts (MW)1 of dispatchable generation retiring over the next ten years amid surging electricity demand driven by data centers, electrification, and industrial growth. Reliability risks are mounting, especially in roughly half of the United States (see map below). The LTRA underscores the challenge of delivering adequate electricity as variable, weather-dependent resources like wind and solar dominate new capacity additions, increasing stress on the natural gas system. In this shifting energy landscape, coal’s dispatchable, fuel-secure generation remains a critical safeguard against energy shortfalls, extreme weather events, and grid instability that can lead to blackouts.

Regions with the largest coal fleets were found to be at either a “High” or “Elevated” risk of shortfalls over the next ten years:

– MISO: High risk due to coal retirements and slow resource additions.

– PJM: Rising demand and inadequate replacement for retiring capacity.

– SPP: Dependence on wind output and natural gas challenges.

– ERCOT: Explosive demand growth with increasing reliance on variable resources.

NERC underscores MISO’s situation as particularly concerning, noting it is at a “High” risk of energy shortfalls with inadequate reserves beginning as soon as 2025. The LTRA indicates that MISO’s accelerated coal retirements, coupled with slower-than-anticipated resource additions, have created a critical gap in the region’s ability to maintain resource adequacy, highlighting the essential role coal has historically played in ensuring grid reliability during peak demand and extreme weather conditions. As recently as the summer of 2023, MISO averted a shortfall thanks to 3,600 MW of delayed coal retirements.

Exploding Demand Growth Paired with Significant Retirements

NERC’s LTRA forecasts a dramatic surge in electricity demand driven by electric vehicle adoption, heating electrification, and industrial expansion, including data centers. Over the next decade, summer peak demand is expected to rise by 132,000 MW (15%) and winter peak demand by nearly 149,000 MW (18%)—the largest increase in two decades and significantly higher than previous years’ projections. Electrification is shifting usage patterns, pushing many regions toward dual or winter-peaking systems, which could strain the natural gas system during extreme weather. PJM alone expects over 25,000 MW of new demand by 2034, driven by data centers. More than half of that new demand is expected to arrive by 2029.

Simultaneously, America’s Power has identified 60,000 MW of announced coal retirements over the next five years, which poses a significant threat to resource adequacy and grid reliability. However, EPA rules are designed to accelerate coal retirements. NERC points to this, explicitly calling out EPA’s Carbon Rule, Coal Combustion Residuals Rule, Effluent Limitations Guidelines, and Mercury Air Toxics Standard and the considerable financial and operational challenges these rules impose on coal-fired generation. (Note that we expect the new administration to rewrite some of these EPA rules.)

Resource Adequacy Challenges

Variable and weather-dependent solar PV, wind, and battery storage are largely replacing retired thermal generation. This shift increases the risk of energy shortfalls, particularly during prolonged periods of low renewable output or extreme weather events. NERC states, “Nameplate values of variable energy resources are not as meaningful as projected energy availability, and environmental conditions can adversely impact the simultaneous availability of thousands of megawatts.”

Most resources in the interconnection queue are weather-dependent and variable, like wind and solar. The report shows that only 15% of the current interconnection queue is dispatchable, meaning the remaining 85%, in NERC’s words, “lack key reliability attributes.” Retiring thermal capacity can be dispatched when needed, stabilizing the grid by providing system inertia, dynamic reactive support, and frequency response. Also worrying is that interconnection queues have long backlogs and low completion rates. Lawrence Berkeley National Laboratory calculates that approximately 14% of the capacity that enters queues is ever completed. The reliability implications of these resources and the delays in bringing them online are why utilities have already reversed or delayed the retirement of 16,000 MW of coal capacity since 2022.

The LTRA notes that as more coal and nuclear generators retire, the system becomes increasingly dependent on natural gas to balance renewable energy variability, challenging natural gas supply during extreme weather. Limited pipeline capacity, competition with residential heating demand, and production disruptions can all lead to fuel shortages for generators, as was observed during Winter Storm Uri in 2021 and Winter Storm Elliott in 2022. NERC has developed a standard, currently being considered by FERC, requiring grid balancing authorities to undertake Energy Reliability Assessments, which, among other things, would look closely at the depletion and replenishment of upstream fuel supplies.

Final Thoughts

Despite NERC’s warnings, coal plant retirements continue. Policymakers must act to retain fuel-secure, dispatchable resources critical for meeting the nation’s energy needs. NERC writes that “[regulators] and ISO/RTOs need to have mechanisms they can employ to extend the service of generators seeking to retire when they are needed for reliability, including the management of energy shortfall risks.” Going even further, for the first time, NERC says, “regulatory and policy-setting organizations must use their full suite of tools to manage the pace of retirements and ensure that replacement infrastructure can be developed and placed in service.”

It is abundantly clear that sound energy policy and the retention of the approximately 170,000 MW of dispatchable, fuel-secure coal generation is critical to the nation’s energy security. Policymakers should heed NERC’s urgent warnings and act on its recommendations to address growing risks to grid reliability.

- NERC notes that 79,000 MW of coal, natural gas, and nuclear retirements are anticipated through 2034, with an additional 43,000 MW of fossil-generation with announced plans to retire but have yet to enter the deactivation process with planning authorities. ↩︎