As the old saying goes, everything is bigger in Texas. That’s especially true of market power prices these days, as hot summer weather has pushed real-time power prices in Texas to their price cap of $9,000 per megawatt-hour (MWh) twice this week. These were just the second and third times that power prices in the Texas market have ever hit their price ceiling, the first being a ten-minute period in January 2018 when a cold snap caused prices to soar. The ceiling is not easy to hit—it’s about three hundred times higher than prices typically are.

With 100-degree plus temperatures hitting the region this week, electricity demand climbed above 74,300 megawatts (MW) on the state’s grid operator (ERCOT), nearly surpassing the grid operator’s all-time record of 74,500 MW. To deal with tremendous demand and skyrocketing prices, ERCOT issued its first level of “Emergency Energy Alerts,” requesting that Texans curb their power usage, that all power plants remain running, and that providers work to import power from other regional markets outside of the state when possible. If necessary, the next step would see ERCOT interrupting power supplies to large customers. If that doesn’t solve the issues with the peak demand bringing the grid to the brink, the grid operator will order rolling blackouts, cutting power to households and everyday consumers.

Why the grid emergency in Texas? For one, the Texas power market has become increasingly reliant on intermittent resources, as coal-fired power plants have been shuttered due to historically low natural gas prices and an increasing penchant by policymakers for wind power. Seeing the potential for a real crisis when demand increases during the hot summer, Texas grid operators have warned for months that the loss of dependable coal-fired power plants could leave the system with razor-thin supply margins. Those warnings proved real as ERCOT’s reserve margin dropped to less than 2,300 MW during the current crisis. Clearly, the current path isn’t working.

What else isn’t working … the wind power upon which Texas has come to depend so heavily.

Consider recent reporting by Bloomberg –

“This week’s price spikes also underscore how dependent the region’s power grid has become on wind farms, which now make up about a quarter of the generation capacity in Texas. Lackluster breezes have contributed to the higher prices,” explained Flannan Hehir a power analyst at energy data provider Genscape.

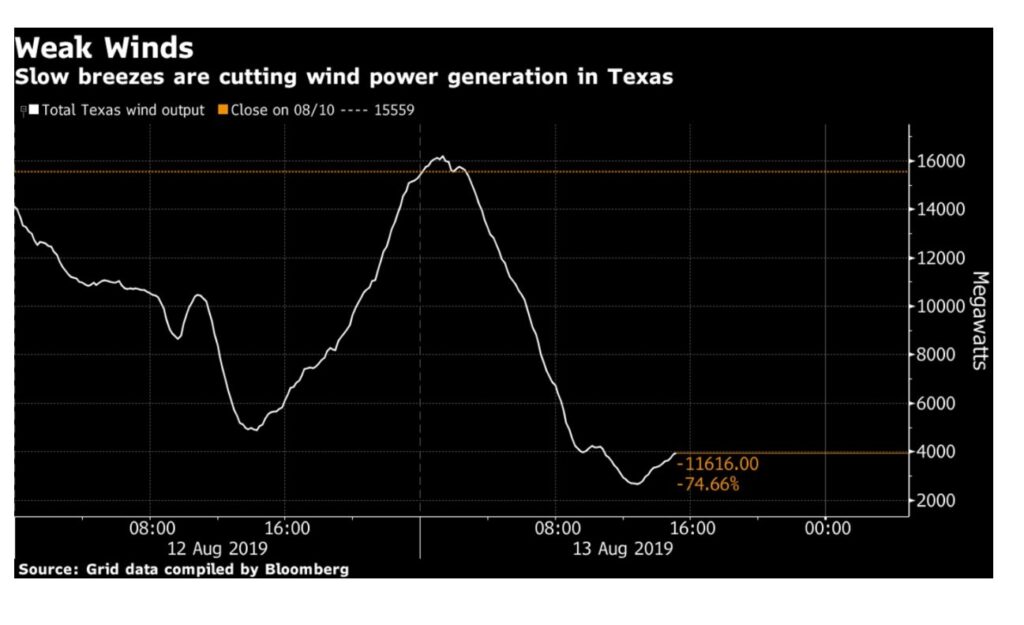

“Wind power generation in the region has plunged for three straight days,” according to Bloomberg data, falling from more than 16,000 MW of generation to less than 3,000.

Texas wind generation in MW on August 12 and 13 as compiled by Bloomberg

Texas wind generation in MW on August 12 and 13 as compiled by Bloomberg

In 2018, Texas lost 5,000 MW of generating capacity from coal plants. These plants were the victims of power prices held artificially low by subsidized wind generation and an ERCOT market that doesn’t compensate generators to stay online for reliability purposes. The truth is that if these highly dependable fuel-secure coal-fired power plants were on the grid today, Texans wouldn’t be facing potential rolling blackouts and market prices wouldn’t have soared to $9,000/MWh.

Other regions are dealing with heat waves, too, but they aren’t seeing skyrocketing power prices. As Texas saw prices rising to $9,000/MWh, nearby Arkansas paid just $30.08/MWh and Mississippi even less at $12.29/MWh. Across the ERCOT system, not a single supply point was below $250/MWh.

What’s happening in Texas should be a wake-up call for the state and for policymakers everywhere. As we are seeing in ERCOT and Texas, the coal fleet is important for maintaining grid reliability and resilience and helps to supply affordably priced electricity. Allowing coal retirements to continue could bring even worse consequences.