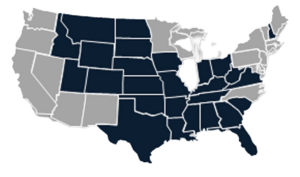

EPA issued its Final Carbon Rule on May 9. The Rule seeks to reduce carbon dioxide emissions by targeting existing coal-fired power plants and new natural-gas fired power plants. The Rule is being challenged in the D.C. Circuit Court of Appeals by 27 states (26 dark states in the map below plus Alaska) and industry groups whose members are impacted by the Rule.

The Rule offers three options for existing coal-fired power plants: (1) retire before 2032, (2) co-fire with natural gas before 2030 and retire before 2039, or (3) install carbon capture and storage (CCS) technology before 2032 and continue to operate. Because the later two options are not technically or economically feasible, the Rule will force virtually all coal-fired power plants to pick the first option and retire before 2032.[i] The resulting coal retirements are likely to cause grid reliability problems.[ii]

Even though legal challenges to the Rule might not be concluded until 2026 or 2027, utilities must start planning and making compliance decisions immediately. These activities entail expenditures that cannot be recouped (“irreparable harm”) if the Rule is eventually overturned by the court.[iii] Final compliance decisions must be made by mid-2026 and must be included in state plans that are submitted to EPA for approval. According to one electricity generator, “We will be forced to make legally binding obligations to close power plants while the Rule is being litigated.”[iv]

America’s Power and others have filed stay motions with the D.C. Circuit to stop EPA from implementing the Rule until the legal challenges have been resolved. Declarations that explain irreparable harm and other impacts to members of America’s Power accompanied the stay motion.[v] The following is a sample of excerpts from some of the declarations.[vi]

- “The incremental capital cost through 2035 to comply with the Final Rule is nearly $10 billion … These costs do not include any costs that would be associated with compliance at [three other Basin coal-fired plants].” Basin Electric Power Cooperative

- “Basin Electric will need to replace approximately 2,600 MW of baseload, dispatchable generation significantly earlier than planned as a result of the Final Rule … Even if [replacement gas units] could achieve 90% CCS, constructing them would cost $11.4 billion as compared to Basin Electric’s current asset base of $8 billion.”

- “Additional expenses resulting from the Final Rule will result in a rate increase of approximately 60% for [Basin] members by 2035.”

- “To supply natural gas to one of Basin Electric’s plants would require an approximately 40-mile pipeline at a cost of approximately $160 million.”

- “CCS at any level tends to make an EGU less reliable. This makes unplanned outages more frequent and more severe … Therefore, the reliability impacts of CCS are another significant risk facing Basin Electric.”

- “… rating agencies will likely view the substantial increase in debt [and other compliance impacts] as negative credit factors … [that] would likely have a negative impact on Basin Electric’s bond ratings ….”

- “Minnkota’s experience with Project Tundra versus EPA’s assumptions in the Final Rule are starkly different.” Minnkota Power Cooperative

- “Minnkota’s planned Project Tundra facility would be the largest CCS project that the world has every seen. Yet because of the Final Rule, it may never get built. That is because this state-of-the-art project is still not enough to bring Minnkota’s Young Station into compliance with the Final Rule.”

- “Although Minnkota strongly supports investment in CCS technology, the Final Rule drastically overstates the technology’s current and future capabilities ….”

- “Project Tundra was first conceived in 2015. At this time, commercial operation is projected to begin in 2029 (if at all). That is a 14-year runway, which is almost triple what the Final Rule contemplates.”

- “Project Tundra is estimated at a cost of over $1.6 billion.”

- “Associated Electric owns, operates, and depends on five coal-fired electric generating units … Replacing [those units] and complying with the Final Rule is expected to have an approximate cost of more than $3 billion ….” Associated Electric Cooperative Inc.

- “Associated Electric … estimates that the total capital costs to convert all five of its coal units [to allow gas co-firing] will be $116,460,000.”

- In addition to the capital costs of conversion (above), “Associated Electric has determined that the closest pipeline … to support New Madrid [has] an estimated capital cost of $243,800,000 to connect to the plant. And for the Thomas Hill facility, the closest pipeline with capacity [has] an estimated capital cost of $52,200,000 to connect.”

- “Even by as early as next year, the rates that Associated Electric charges are expected to increase more than 50% above the increase that would be expected” without the Final Rule. “That expected increase is due directly to the massive costs that the Final Rule creates.”

- Two coal-fired units “have remaining useful lives that will be significantly shortened under the Final Rule. Replacing the generation from these units and complying with the Final Rule is expected to have an approximate cost of up to $470 million.” Arkansas Electric Cooperative Corporation

- “Arkansas Electric would need to replace approximately 335 MW of baseload, dispatchable generation as a result of the Final Rule.”

- “The Rule will result in the premature retirement of [two plants], leaving significant stranded asset costs … simply using the estimated book values to represent stranded costs … yields estimates of approximately $154.7 million and $97.6 million, respectively.”

- “The Final Rule imposes substantial financial harm to East Kentucky by stranding existing debt on its coal-fired assets. East Kentucky would still hold $774.811 million in debt for the units at Spurlock on the compliance date to shut down coal ….” East Kentucky Power Cooperative

- “The CCS capital project on its own would cost $6.2 billion for all four Spurlock units … [E]stimated operating costs of CCS equipment would total $17.74 per megawatt-hour annually. The cost of storing CO2 adds another $2.2 billion, which would have to be transported to Illinois as the closest feasible storage location at a cost of over $3.7 billion. The grand total is $10.7 billion, collectively.”

- “Although CCS is a promising technology, the deployment of CCS is a mammoth, multi-phase undertaking that requires substantial lead time, significant resources, major financial expenditures, and both state and federal regulatory support.” Meeting the rule’s CCS requirement “has never been accomplished anywhere in the world.” Prairie State Generating Company

- “[R]etrofitting one unit at the PSEC [with CCS] would cost roughly $2.04 billion; that cost does not include an estimated $176 million in additional annual operating and maintenance costs, property and income taxes, insurance costs, or the costs to transport and permanently sequester the CO2.”

- “As soon as Buckeye is required to make a binding commitment to retire these units … these units will no longer be able to be listed as plant in service or to be depreciated on Buckeye’s books. If the remaining book value is immediately expensed, this will result in a massive rate increase to the Buckeye members in that single year. For example, the expected book value of Cardinal Unit 2 alone in 2026 is $380 million. If this amount were to be immediately expensed this would represent a rate increase of 44% in that year as compared to current financial forecast of rates for that year.” Buckeye Power, Inc.

- “Rating agencies may lower Buckeye’s credit ratings as a result of the Final Rule and the 2026 binding commitment to retire by the end of 2031, and lenders may increase their borrowing costs to Buckeye, coal suppliers, and other vendors and service providers dependent on coal-fired EGUs as customers.”

- “[R]eplacing the Cardinal Units with market power for just eight years will cost approximately $800 million to $1.3 billion … all costs that would ultimately be borne by the consumers in Buckeye’s area.”

- “The likely decision to retire the Four Corners Power Plant because of the Final Rule would likewise result in NTEC’s decision to shutter the Navajo Mine. Such a decision would have extreme negative ramifications for … hundreds of individual Indians employed at the Navajo Mine and Four Corners Power Plant whose employment would be terminated, but also a massive impact to NTEC’s sole shareholder, the Navajo Nation, who would be deprived of more than thirty-nine percent of its annual budget.” Navajo Transitional Energy Company

- “[U]ncertainty around the Carbon Rule and subsequent regulations have precluded several of [Peabody’s] customers from purchasing coal supplies beyond fiscal year 2026, which fundamentally affects [Peabody’s] ability to make accurate capital allocation and hiring decisions due to the long planning cycle involved in operating mines.” Peabody Energy Corporation

- “CONSOL employs 2,039 individuals and, in 2023, paid approximately $200 million in federal, state, and local taxes.” The Final Rule “will have a direct and immediate impact on profitability, investments and operations by forcing CONSOL to reduce production, make associated reductions in the workforce, delay and curtail capital investments in its mines, seek to reduce other operating costs, decline to bid or invest in new coal leases, and/or otherwise plan for reduced and uncertain future operations.” CONSOL Energy Inc.

These are only a few of the reasons we hope that stay motions will be granted, and courts will ultimately overturn the Carbon Rule.

To learn more about the coal fleet, the coal supply chain, and electric reliability please visit www.americaspower.org.

________________________________________________________________

[i] EPA has also finalized other rules that will cause coal retirements prior to 2032: Ozone Transport Rule, Mercury and Air Toxics Standards, and Effluent Limitations Guidelines. All three are in litigation or are expected to be challenged soon in the courts.

[ii] For example, the Southwest Power Pool released a press statement on May 20 “EPA Rule Could Severely Impact Nation’s Efforts Toward Energy Production, Reliability,” referring to the Carbon Rule.

[iii] Examples of these activities include, but are not limited to, planning, designing, permitting, siting, engineering, and constructing gas pipelines; capital expenditures to modify boilers for gas co-firing; design and modeling studies for new CCS projects; re-engineering, new studies, incurring additional project development costs, and obtaining environmental permits and other authorizations for existing CCS projects; planning studies for new electric transmission; and substantial capital expenditures to start building new electric generating capacity to replace retiring coal capacity.

[iv] Declaration of Gavin McCollam, Senior Vice President and Chief Operating Officer, Basin Electric Power Cooperative, May 10, 2024.

[v] A declaration is a written statement submitted to a court in which the writer swears under penalty of perjury that the contents are true. That is, the writer acknowledges that if he/she is lying, he/she may be prosecuted for perjury. https://www.upcounsel.com/legal-def-declaration

[vi] Declaration of Gavin McCollam, Senior Vice President and Chief Operating Officer, Basin Electric Power Cooperative, May 10, 2024. Declaration of Randy Short, President and CEO, Prairie State Generating Company, April 30, 2024. Declaration of Robert McLennan, President and CEO, Minnkota Power Cooperative, May 10, 2024. Declaration of Matthew D. Babcock, Vice President Sales & Marketing, Navajo Transitional Energy Company, May 23, 2024. Declaration of Vernon Hasten, President and CEO, Arkansas Electric Cooperative Corporation, May 9, 2024. Declaration of Jerry Purvis, Vice President of Environmental Affairs, East Kentucky Power Cooperative, May 9, 2024. Declaration of David J. Tudor, CEO & General Manager, Associated Electric Cooperative Inc., May 10, 2024. Declaration of Craig Grooms, Chief Operating Officer, Buckeye Power, Inc., May 9, 2024. Declaration of Marc E. Hathhorn, President U.S. Operations, Peabody Energy Corporation, May 9, 2024. Declaration of Robert Braithwaite, Jr., Senior Vice President Marketing & Sales, CONSOL Energy Inc.

For additional information, please visit www.AmericasPower.org.