If you’re reading this, chances are you might have heard about PJM’s recent sky-high auction prices for electric generating capacity. PJM, the largest electric grid operator in the nation, conducts an auction annually to ensure that its 13-state region has sufficient electric generating capacity − roughly speaking, enough power plants − to meet its future electricity demand. The purpose of the recent auction was to procure generating capacity for 2025/26.

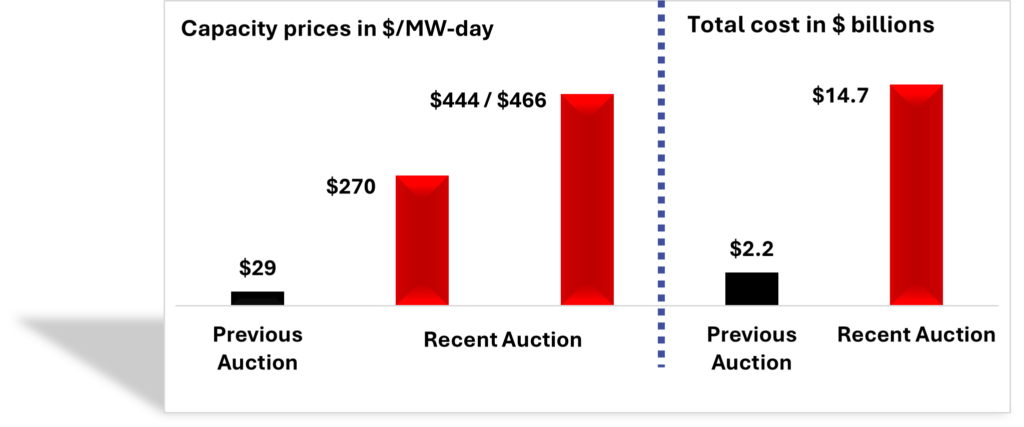

The most striking thing about the auction was the unprecedented increase in capacity prices. Prices across the PJM region increased by a factor of nine (or 830%), from almost $29/megawatt-day (MW-day) in the previous auction to approximately $270/MW-day in the most recent auction. Moreover, two regions in PJM saw capacity prices increase to $444/MW-day and $466/MW-day (left side of the chart below). The total cost to meet PJM’s needs for electric generating capacity increased from $2.2 billion in last year’s auction to $14.7 billion this year, a cost that will ultimately be borne by ratepayers (right side of the chart).

Energy Ventures Analysis (EVA) has authored a report about the auction: “Results and Likely Impacts of PJM’s 2025/26 Base Residual Auction,” which we encourage you to read. According to the report, three factors drove the record-setting prices for capacity:

- An increase in electricity demand. PJM increased its peak load forecast by 2.2% (3,200 MW) because of electric vehicles and growth in data centers. (For perspective, this increase is roughly equivalent to seven coal-fired generating units.)

- A higher reserve margin. PJM increased its reserve margin from 14.7% to 17.8%. A higher reserve margin is needed to help avoid future reliability problems. This increase in reserve margin was a response to reliability problems during past extreme weather events.

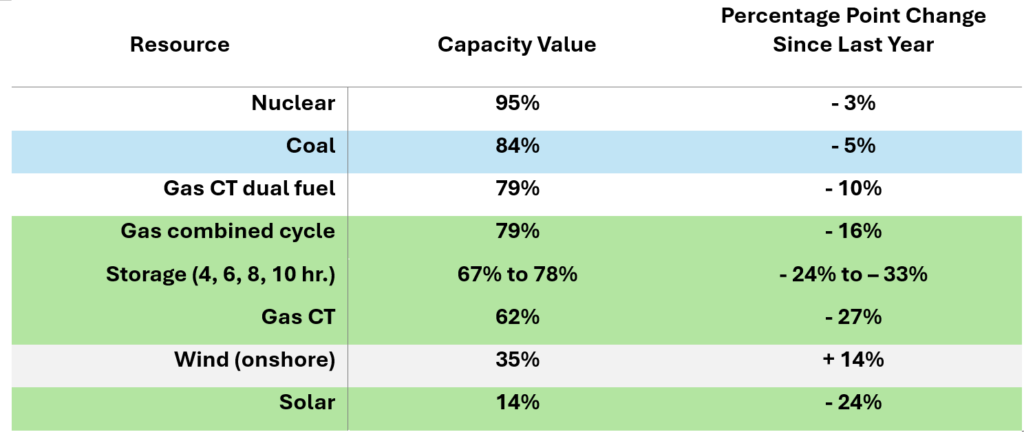

- Changes in capacity accreditation. Capacity accreditation (synonymous with “effective load carrying capability” or “capacity value”) is a measure of how dependable an electricity resource is when the risk of an electricity outage is greatest. For example, most renewable electricity resources rely on the wind and sun and, therefore, have a lower capacity value than other (dispatchable) resources because they might not be able to generate electricity at times when electricity is needed the most. Note that coal (blue below) is the second most dependable resource with a capacity value of 84%, and solar is the least dependable at 14% (green). Also, PJM significantly reduced the capacity values for battery storage, natural gas combined cycle and simple cycle units, and solar resources (green).

Our biggest takeaway from the auction is the need to stop coal retirements in order to prevent the PJM electricity supply from shrinking even further and causing continued high capacity prices. According to EVA, “Preventing any additional near-term [fossil] power plant retirements across the PJM footprint will be paramount to meeting the capacity requirements of future PM capacity auctions, especially given the status of PJM’s current Interconnection Queue.” During 2021-2023, slightly more than 12,000 MW of coal retired in PJM. In addition, utilities have announced plans to retire another 13,250 MW of PJM coal during 2024-2028. (Some 1,400 MW of this retiring coal capacity are converting to natural gas.) Beyond 2028, PJM’s entire coal fleet (currently 40,000 MW) is at risk of retiring before 2032 because EPA’s Clean Power Plan 2.0 and other EPA rules make it increasingly unprofitable for coal plants to continue operating. EVA’s report added that “it is unlikely that PJM’s capacity woes will subside in the near future.” This is not good news for ratepayers.