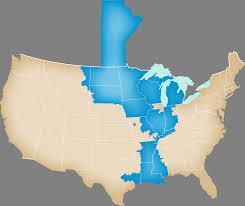

Recently, the Midcontinent Independent System Operator (MISO) issued a 217-page report ― MISO’s Renewable Integration Impact Study (RIIA) ― about the challenges and risks to the electricity system in the grid operator’s 15-state region[i] (blue in the map) as more wind and solar power is added to the region’s electricity mix.

Wind and solar are intermittent resources, meaning they produce electricity only when weather conditions are favorable. The other term for wind and solar is non-dispatchable, as opposed to coal, natural gas, and nuclear power plants which are dispatchable because their electricity output can be increased or decreased (dispatched) based on electricity demand. Relying too much on wind and solar can be a problem when the sun isn’t shining or the wind isn’t blowing. Consider California, whose heavy reliance on solar power and lack of enough dispatchable electricity sources left some 2.4 million people without power last August.[ii] (To add insult to injury, California had the seventh highest electricity rate in the country in 2019, 60 percent higher than the national average.[iii])

Is MISO at risk of becoming like California?

Currently, MISO has a diverse mix of electricity resources. Fossil fuels make up 70 percent of the mix (41 percent natural gas and 29 percent coal), and wind makes up 13 percent.[iv] The remainder is nuclear and other resources, including a tiny amount of solar power. Last year, the MISO coal fleet generated 33 percent of MISO’s electricity, second to natural gas at 34 percent.[v] MISO has a larger coal fleet (slightly more than 57,000 megawatts of installed capacity[vi]) than any other grid operator.

MISO is smart enough to explore the problems that could be caused by too much wind or solar. The RIIA assumed that more wind and solar would be added in the future and, therefore, looked at what kinds of problems that might cause.[vii] The highly technical report can be interpreted in different ways. To us, it says that there could be major problems once wind and solar increase to almost one-third of the region’s electricity supply. (California’s is almost 30 percent solar and wind.[viii]) One of the reasons is the lack of dispatchable electricity resources, such as coal, that are necessary to make sure the MISO electricity grid is reliable and resilient.

We wrote the Organization of MISO States (OMS), commending MISO for the report but, at the same time, suggesting the grid operator should look more closely at how long it might take to add more wind and solar power to the MISO grid. If more renewables are added over a reasonable period of time, MISO could avoid, or at least minimize, any problems. On the other hand, adding lots of wind and solar over a short time period could make it much harder to keeps the lights on and electricity prices affordable. For example, President Biden’s goal to decarbonize the grid by 2035 would run into a number of problems including, but not limited to, the time and cost to add new transmission, having dispatchable generation when the sun is not shining and the wind is not blowing, developing cost-effective battery storage, providing fuel security, paying for stranded investments, and changing wholesale market rules. These problems cannot be overcome in a short period of time.[ix]

Also, the RIIA did not address whether the MISO electricity system would be resilient with the addition of more wind and solar. This is an issue that MISO should evaluate carefully, especially in light of February’s winter storm that caused brief blackouts in MISO.

To learn more, you can find the following on our website:

- Letter to the Organization of MISO States regarding the MISO Renewable Impacts Integration Assessment (RIIA)

- America’s Power’s Remarks to MISO Board on the Importance of Grid Resilience

- Quanta Summary of MISO Renewable Integration Impact Assessment Report (RIIA)

- “California Unplugged: A Cautionary Tale”

[i] MISO’s territory includes all or part of 15 states and the Canadian province of Manitoba. The 15 states are Arkansas, Illinois, Indiana, Iowa, Kentucky, Louisiana, Michigan, Minnesota, Mississippi, Missouri, Montana, North Dakota, South Dakota, Texas, and Wisconsin.

[ii] “CAISO Says Constrained Tx Contributed to Blackouts,” October 8, 2020, RTO Insider. https://rtoinsider.com/rto/caiso-constrained-transmission-contributed-blackouts-175322/

[iii] According to EIA’s State Electricity Profiles (release date November 2, 2020), California’s average retail electricity price was 16.89 cents/kWh in 2019. The U.S. average retail electricity price was 10.54 cents/kWh.

[iv] Installed capacity in MISO balancing authority from monthly EIA 860 data https://www.eia.gov/electricity/data/eia860/

[v] Historical generation fuel mix for 2020 from https://www.misoenergy.com

[vi] Installed capacity in MISO balancing authority from monthly EIA 860 data https://www.eia.gov/electricity/data/eia860/

[vii] For the assessment, MISO assumed specific levels of renewables penetration from 10 percent to 50 percent.

[viii] CAISO has 11,680 MW of solar and 6,620 MW of wind. These comprise slightly more than 29 percent of CAISO’s installed generating capacity. This information is from historical capacity data based on EIA 860 data (https://www.eia.gov/electricity/data/eia860/). Forecasted capacity data based on Energy Ventures Analysis’ FUELCAST 2020 Long-term Outlook.

[ix] In addition to the cost of new transmission, completing the necessary transmission projects by 2035 will be virtually impossible because the process of identifying, permitting, and building new transmission lines is lengthy. This challenge is illustrated by the Transwest Express Transmission Line, a 700-mile, 3,000-MW capacity line intended to deliver wind power from Wyoming to Nevada and California. Development of the project began in earnest in 2005, but final permits were not received until 2020, with construction finally scheduled to run from 2022 to 2024, nearly 20 years after the project began. Even with federal and state support and approval, new transmission projects can be delayed or abandoned due to local opposition. For example, the Plains & Eastern Clean Line transmission project was a 700-mile, $2.5-billion project begun in 2010 to bring wind power from Texas and Oklahoma to serve eastern power demand. Despite federal and state approvals and support from the Department of Energy, the project was essentially abandoned eight years later due to local opposition along the construction route. Other transmission projects are taking 17 years or more to complete.