In order to promote the growth of renewable electricity sources, such as wind and solar, the federal government has given them special tax incentives. Chief among these are the production tax credit (PTC), which has been used primarily by wind generation and awards a substantial tax credit for every megawatt-hour (MWh) produced; and the investment tax credit (ITC), which is primarily used by solar electricity generators as a credit against construction costs. PTCs and ITCs can amount to more than one-third of the cost of building and operating wind and solar facilities.[i]

These tax incentives were intended by Congress to support technology that was too expensive in its early development. Over time, these tax credits accomplished their goals, as wind and solar power have increased from just over 4% of the nation’s electric generating capacity in 2010 to nearly 13% today (9.5% for wind and 3.5% for solar). Although initially a temporary program, Congress has extended these subsidies several times in recent years as they were about to expire. The PTC for wind is now set to expire at the end of 2020, but renewable energy advocates are pushing to extend them again. The following are reasons renewable subsidies should not be extended.

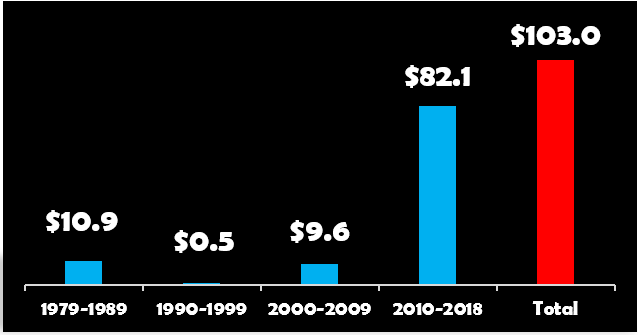

Over $100 billion has already been spent on renewables subsidies.

Renewable energy resources—primarily wind and solar—have received subsidies through the tax code since 1979, most of which have occurred in the last decade. Through 2018, these subsidies amounted to more than $100 billion. This amount is far in excess of federal assistance received by other electricity sources. And for perspective, this exceeds the combined 2020 budgets for the Department of Homeland Security, the Department of Energy, the Department of the Interior, and the Environmental Protection Agency.[ii]

Tax Subsidies for Renewable Energy (2019 $Billion)[iii]

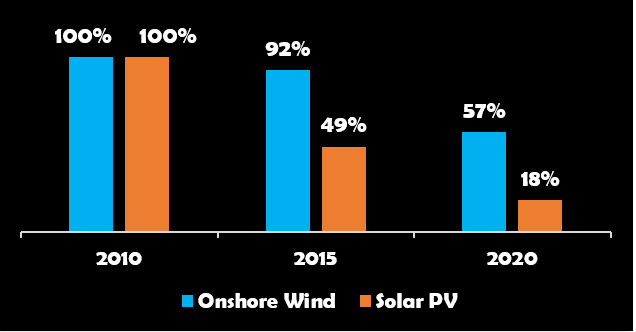

Wind and solar are no longer at a cost disadvantage.

One of the stated goals of renewable energy subsidies and mandates has been to stimulate demand for wind and solar technology in the hope that their high costs would decline.[iv] This goal has been achieved. In 2020, the U.S. Energy Information Administration (EIA) estimated the total overnight cost of new on-shore wind capacity to be $1,319 per kilowatt (kW), a 43% drop from its estimate in 2010 of $2,325 per kW. For solar photovoltaic capacity, EIA’s 2020 estimate is 82% lower than it was ten years earlier ($1,331 vs. $7,297 per kW). For new sources of electricity, it now costs less to build and generate electricity from new wind and solar facilities than from a new natural gas facility, its chief competition in providing new power supplies.[v] (However, it can be less expensive to continue operating existing power plants, rather than replace them with new electricity sources like wind and solar.[vi])

EIA Cost of New Renewables (2010 = 100%)[vii]

Even the renewables industry says subsidies are no longer needed.

Numerous widely-reported studies by advocates of renewable power have documented the declining cost of wind and solar generation and concluded that these resources are now cost-competitive with conventional electricity sources. One example comes from the International Renewable Energy Agency (IRENA), an intergovernmental organization that performs research and analysis to promote the growth of renewable power: “In most parts of the world today, renewables are the lowest-cost source of new power generation. As costs for solar and wind technologies continue falling, this will become the case in even more countries …”[viii] The American Wind Energy Association (AWEA) also believes wind is now competitive without federal subsidies: “Growth in the wind industry is expected to remain strong when the PTC is fully phased-out. Because the PTC has been successful in helping establish a reliable, competitive domestic wind industry, wind will continue to expand capacity …”[ix]

Subsidized renewables have distorted the electricity grid.

Wind and solar power do not provide the same value to the grid as conventional electricity sources. In addition to not operating on-demand, they provide little of the capacity value that is needed to maintain long-term reliability and cannot be relied on to provide the essential reliability services the grid needs to maintain reliability. Instead, they rely on other electricity generators to provide the services they cannot, thus “imposing” those costs on other generators and the grid. Though the wind and solar facilities do not pay these costs, ratepayers do.

A Texas heat wave in August 2019 provides a good example of how renewables can distort electricity grid operations. In the prior ten years, wind capacity had grown from 10% to 26% of capacity in the Texas power market (ERCOT).[x] The low marginal cost of subsidized wind power depressed market prices for electricity to the point where over 5,000 MW of conventional generation chose to retire in 2018 rather than continue losing money. With electricity demand reaching record levels, these retirements combined with an unpredicted drop in wind generation to force ERCOT to enact emergency procedures to avoid blackouts. Although blackouts were avoided, electricity prices that were under $20 per MWh in the morning of August 13, 2019 rose to $9,000 per MWh in the afternoon.[xi]

Federal subsidies for renewables have not lowered consumer electricity costs.

The ITC and PTC subsidies have lowered out-of-pocket costs for renewable project developers but have not led to similar savings for electricity ratepayers. This is evident when examining states that have enacted renewable portfolio standards (RPS) that require utilities to procure renewable power. A study from the Energy Policy Institute at the University of Chicago examined the impact RPS programs had on electricity rates across the country and concluded they led to higher electricity rates. Rates increased by 11% when the share of renewable generation increased by 1.8%, and by 17% when the renewable share increased by 4.2%.[xii] According to the study, “These cost estimates … likely reflect costs that renewables impose on the generation system, including those associated with their intermittency, higher transmission costs, and any stranded asset costs assigned to ratepayers.”

A large portion of subsidies are sent overseas.

Much of the wind and solar power deployed in the United States is owned by foreign firms, and the tax credits that these power projects generate are collected by international corporations. One study found that of the $24.5 billion in PTC credits awarded between 2007 and 2016, just 15 companies received three quarters of those credits, and 42% of that total ($8.2 billion) went to seven overseas firms.[xiii]

There is no longer a compelling reason to extend federal subsidies for renewables.

Continued subsidies are no longer needed to support a fully developed renewables industry. After four decades of federal subsidies and state mandates, the wind and solar industries are mature and able to compete on equal footing with conventional sources of electricity. As AWEA said, “the PTC has been successful …” Or as we put it, enough is enough.

[i] The PTC for wind farms that begin construction in 2020 is $15 per MWh, which is 44% of the $34.10 per MWh levelized cost of building and operating a new on-shore wind facility in 2020 (EIA, Levelized Cost and Levelized Avoided Cost of New Generation Resources in the Annual Energy Outlook 2020, February 2020). In 2016, new wind was eligible for a $23 per MWh PTC, 39% of that year’s EIA levelized cost estimate of $58.5 per MWh (EIA, Levelized Cost and Levelized Avoided Cost of New Generation Resources in the Annual Energy Outlook 2016, August 2016).

[ii] The 2020 budgets for the four agencies are as follows: DHS – $51.7 billion, DOE – $31.7 billion, DOI – $12.6 billion and EPA – $6.07 billion.

[iii] Congressional Research Service, Energy Tax Policy: Historical Perspectives on and Current Status of Energy Tax Expenditures, Report for Congress R41227, May 2, 2011. Congressional Research Service, Energy Tax Incentives: Measuring Value Across Different Types of Energy Resources, Report for Congress R41953, March 19, 2015. Congressional Research Service, Energy Tax Policy: Issues in the 114th Congress, Report for Congress R43206, June 15, 2016. Congressional Research Service, The Value of Energy Tax Incentives for Different Types of Energy Resources: In Brief, Report for Congress R44852, May 18, 2017. Congressional Research Service, The Value of Energy Tax Incentives for Different Types of Energy Resources, Report for Congress R44852, Updated March 19, 2019.

[iv] Congressional Research Service, The Renewable Electricity Production Tax Credit: In Brief, CRS Report R43453, November 27, 2018.

[v] U.S. Energy Information Administration, Levelized Cost and Levelized Avoided Cost of New Generation Resources in the Annual Energy Outlook 2020, February 2020.

[vi] “The Levelized Cost of Electricity from Existing Generation Resources,” Tom Stacy and George Taylor, June 2019. www.americaspower.org

[vii] Total overnight capital costs, converted to real 2019 dollars, from U.S. Energy Information Agency’s Annual Energy Outlook 2010 through 2020, https://www.eia.gov/outlooks/aeo/.

[viii] IRENA, Renewable Power Generation Costs in 2018, International Renewable Energy Agency, 2019. Quotations are from “Key Findings” on p.9.

[ix] https://www.awea.org/policy-and-issues/tax-policy, queried April 15, 2020.

[x] S&P Global Market Intelligence data.

[xi] http://www.ercot.com/mktinfo/prices/

[xii] Greenstone, M., and I. Nath. “Do Renewable Portfolio Standards Deliver?” Energy Policy Institute at the University of Chicago Working Paper 2019-62, April 2019.

[xiii] Erickson, Angela C., The Production Tax Credit: Corporate Subsidies and Renewable Energy, Texas Public Policy Foundation, October 2018.