A recent report by Grid Strategies, “The Cost of Federal Mandates to Retain Fossil-Burning Power Plants,”[i] claims that orders issued by the Department of Energy (DOE) to keep fossil power plants operating for reliability purposes instead of retiring could cost $3 billion per year and perhaps as much as $6 billion per year by the end of 2028. The report was sponsored by four national environmental organizations who are not fans of fossil power plants. We looked behind the claims to see if these cost estimates make sense. For perspective, keep in mind that customer expenditures nationally for electricity total close to $500 billion per year.[ii]

By way of background, Section 202(c) of the Federal Power Act gives DOE the authority to issue temporary orders that require power plants that are needed during an “emergency” to operate until the emergency ends.[iii] An inadequate supply of electricity qualifies as an emergency for purposes of Section 202(c). The North American Electric Reliability Corporation, which is responsible for monitoring the health of the U.S. electricity grid, has warned about the possibility of inadequate electricity supplies in more than half the country.[iv] One of the main reasons for this warning is the retirement of fossil power plants.

Once signed by the DOE Secretary, a 202(c) order remains in effect until the emergency is over. Generally, an order lasts for no more than 90 days but can be extended for as long as the emergency lasts.[v] DOE has issued 202(c) orders 27 times since 2000. Twenty-five of these orders were in effect for 90 days or less. A recently-issued order will have been in effect for 6 months by the time it ends in mid-November, and another order was in effect for 18 months during 2005-2007.[vi] These timeframes are important because Grid Strategies assumes that each new 202(c) order – perhaps totaling as many as 90 orders − would be in effect for one year.

GRID STRATEGIES ASSUMPTIONS

The following are key assumptions that are the basis for Grid Strategies estimated costs of $3 billion (called a “low estimate”) and $6 billion (called a “high estimate”) in 2028.

“Possible Retirements” The report assumes that all fossil power plants that have announced intentions to retire by 2028 will actually retire. For shorthand, we call these “possible retirements.” According to Grid Strategies, possible retirements total almost 35,000 MW (54 individual plants). Also, the report assumes that all 54 plants would receive 202(c) orders, and every order would extend for one year. These assumptions are the basis for the report’s low-cost estimate of $3 billion.

“Speculative Retirements” In addition to the possible retirements above, the report assumes that 36 fossil power plants (almost 31,400 MW) that are currently 60 years old would retire by 2028. For shorthand, we call these “speculative retirements.” The report assumes that all speculative retirements would also receive 202(c) orders, and every order would extend for one year. Therefore, possible retirements plus speculative retirements total 90 fossil power plants representing almost 66,400 MW.[vii] These are the basis for the report’s high-cost estimate of $6 billion.

Compensation To operate under an order, each possible and speculative retirement is assumed to receive the average cost ($89,315/MW-yr) for one year that has been paid to fossil power plants that have operated under reliability-must-run (RMR) agreements.

Cost Estimates The cost estimates are simple to derive based on the Grid Strategies Assumptions.[viii] The following is the estimated cost nationally according to Grid Strategies:

- (34,948 MW) x ($89,315/MW-yr) x (1 yr) = $3.121 billion by year end 2028.

The following is the estimated cost for possible plus speculative retirements (high-cost estimate) according to Grid Strategies:

- Substituting more retirements (66,337 MW) into the equation above equals $5.925 billion by year end 2028.

ALTERNATIVE ASSUMPTIONS

Obviously, no one knows for sure what will happen over the next three years or what the cost of DOE orders might be if they are needed to maintain reliability. However, to illustrate how the Grid Strategies Assumptions affect cost estimates, we considered the possible cost under three Alternative Assumptions: (a) only half of the possible and speculative retirements actually occur, (b) only half of these retirements receive DOE orders, and (c) the orders extend for 90 days, not one year. We think these Alternative Assumptions are just as plausible as the Grid Strategies Assumptions.

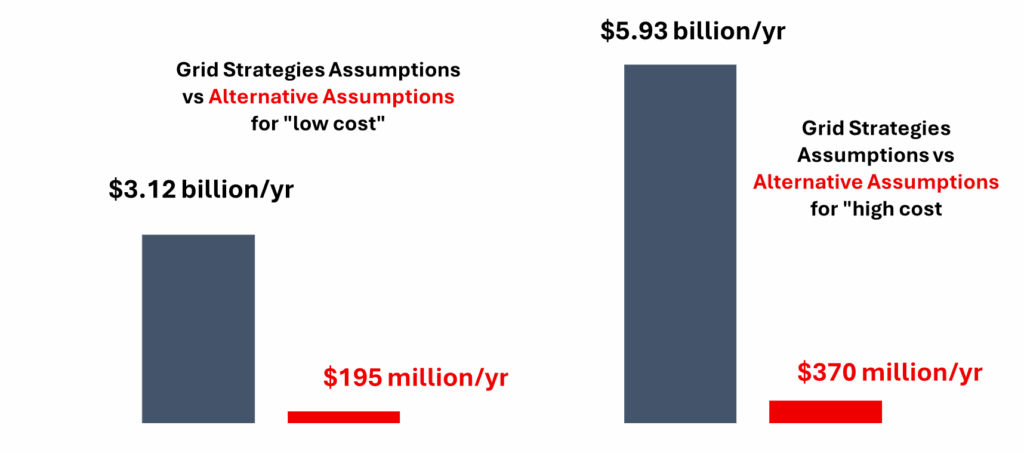

Under Alternative Assumptions, the national low-cost estimate would be $195 million/yr, compared to Grid Strategies $3.12 billion/yr, and $370 million/yr for a high-cost estimate, rather than $5.9 billion/yr. The chart below shows the difference between the two sets of assumptions. Grid Strategies costs are more than an order of magnitude greater than the costs under Alternative Assumptions.

This same large difference holds for each region and state listed in the report. For example, the estimated cost to MISO is $68 million/yr under Alternative Assumptions compared to $1.08 billion under Grid Strategies Assumptions. Likewise, PJM’s cost is $46 million/yr under Alternative Assumptions versus $732 million/yr under Grid Strategies Assumptions.

FINAL THOUGHTS

None of these cost estimates are predictions, and assumptions are basically what-ifs. However, we believe the costs based on Alternative Assumptions are more likely than not to be closer to the actual cost of 202(c) orders because, among other reasons, it seems unlikely that every possible (35,000 MW) and speculative (more than 31,000 MW) retirement will actually happen within the next three years and that every retiring plant will receive a 202(c) order directing it to continue operating for one year. There are a couple of reasons to be a little skeptical about the large number of retirements assumed by Grid Strategies. One is that load growth and other factors are driving utilities to reassess their plans to retire fossil power plants. For example, utilities have already deferred the retirement of almost 29,000 MW of coal-fired generation for a number of reasons, including concerns about load growth and reliability.[ix] Another is that EPA is rewriting or repealing a number of regulations that were expected to cause more fossil power plant retirements.[x]

[i] Michael Goggin, “The Cost of Federal Mandates to Retain Fossil-Burning Power Plants,” Grid Strategies LLC, August 2025. According to Grid Strategies, the report was prepared on behalf of Earthjustice, Environmental Defense Fund, Natural Resources Defense Council, and the Sierra Club.

[ii] According to EIA, end use electricity expenditures totaled $488 billion in 2023, which is the most recent data from EIA. https://www.eia.gov/todayinenergy/detail.php?id=62945

[iii] For additional information, see “Federal Power Act: The Department of Energy’s Emergency Authority,” Updated July 1, 2025, Congressional Research Service.

[iv] See NERC “2024 Long-Term Reliability Assessment, December 2024, Updated July 15, 2025.”

[v] For example, DOE issued an initial 30-day order in May to keep the 1,420 MW coal-fired Campbell power plant running. Recently, DOE extended the order another 90 days to mid-November because of concerns about shortfalls in both electricity and generating capacity in the MISO region where the plant is located.

[vi] “DOE’s Use of Federal Power Act Authority,” accessed August 20, 2025. https://www.energy.gov/ceser/does-use-federal-power-act-emergency-authority#:~:text=On%20September%204%2C%202022%2C%20the,effect%20until%20September%208%2C%202022.

[vii] The report lists the 54 possibly retiring plants but does not list plants that are speculative retirements.

[viii] For the sake of argument, we assume that the average cost of RMR agreements and the number of possible and speculative retirements are correct.

[ix] Energy Ventures Analysis maintains a proprietary data base that tracks both coal retirements. Currently, the retirement of 56 generating units has been deferred; these total roughly 28,700 MW.

[x] These regulations include Clean Power Plan 2.0, Regional Haze, Good Neighbor Plan, Mercury and Air Toxics Standards, Effluent Limitations Guidelines, and Coal Combustion Residuals.