“Our country has a severe interconnection queue backlog,” commented Chairman Willie Phillips at a recent FERC workshop. As electricity demand explodes and power plant retirements mount, utilities are rushing to ensure they will have adequate, reliable supplies of electricity over the next 5 to 10 years. The discussion of new sources of electricity invariably leads to the topic of interconnection queues. The queue is a list maintained by electric transmission system operators, such as Independent System Operators (ISOs), Regional Transmission Organizations (RTOs), or utilities that track all pending requests for new power generation facilities—including wind, solar, gas, energy storage, nuclear, and other sources—to connect to the electricity grid.

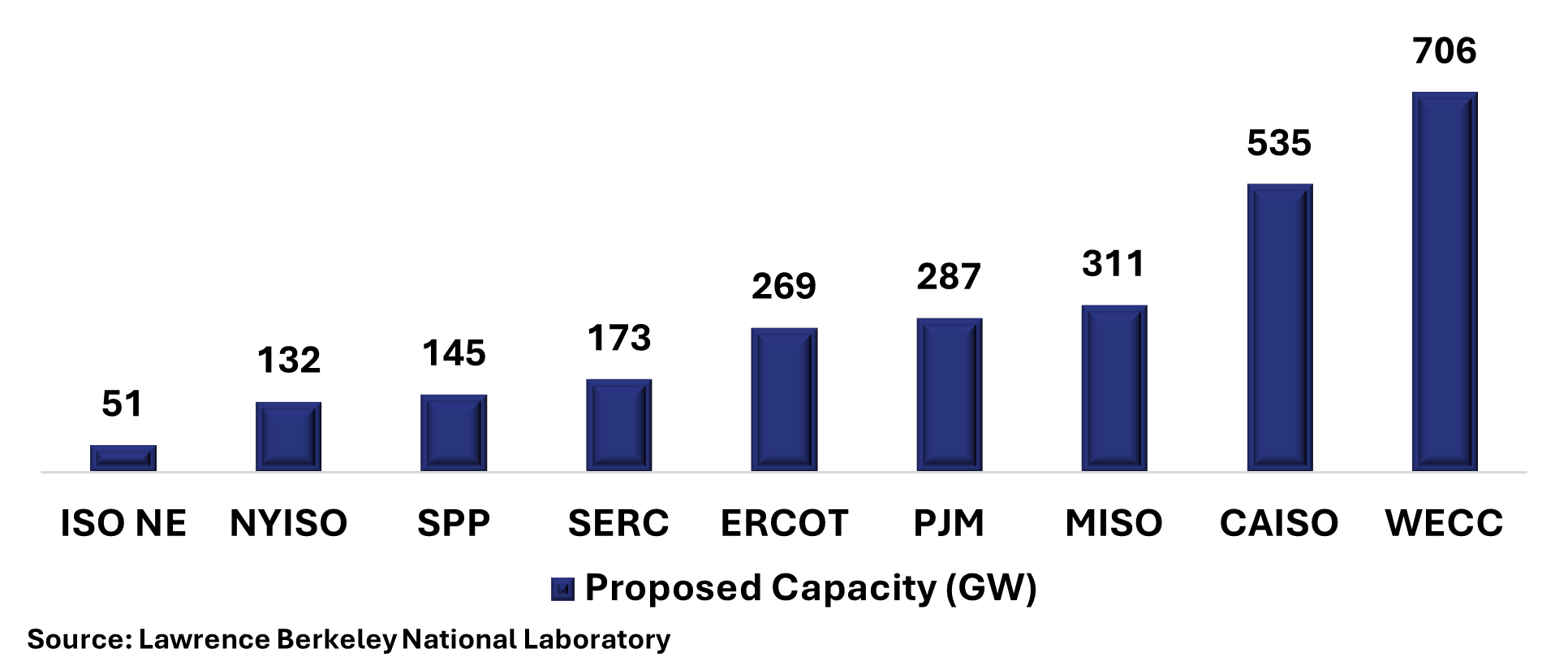

According to the Lawrence Berkeley National Laboratory, at the end of 2023, almost 2,600 gigawatts (GW) of generation projects were sitting in interconnection queues nationally. That is more than double the approximately 1,170 GW of existing generation currently on the grid. Of the 2,600 GW of projects in the queue, only 3% are fossil fuels, and 97% are intermittent renewables or storage.[i] The chart below shows the proposed capacity by region at the end of 2023.

Berkeley Lab notes that much of this proposed capacity will never be connected to the grid. According to Berkeley Lab, “only 14% of capacity requesting interconnection from 2000-2018 reached commercial operations by the end of 2023.”[ii] Five years ago, the interconnection queues contained only 733 GW, a little more than one-quarter of the current total. Berkeley Lab notes that clean energy incentives have driven interconnection queue additions with over 1,200 GW of capacity, overwhelmingly renewables and storage, entering the queues since the passage of the Inflation Reduction Act in 2022.[iii] This remarkable upsurge in interconnection requests has overwhelmed grid operators’ ability to analyze and approve these projects in a timely manner.

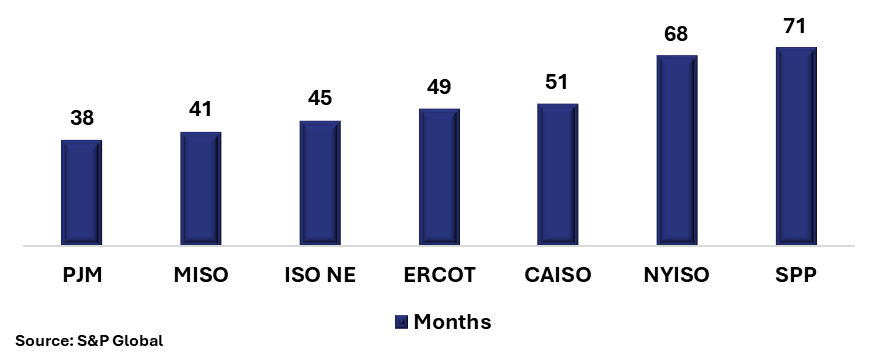

The time projects must spend in the interconnection queue has risen dramatically. Projects built in 2023 took 5 years to complete; this was only 3 years in 2015 and less than 2 years in 2008.[iv] According to an analysis by S&P Global, interconnection queue wait times ranged from 38 to 71 months in the wholesale ISO/RTOs.[v]

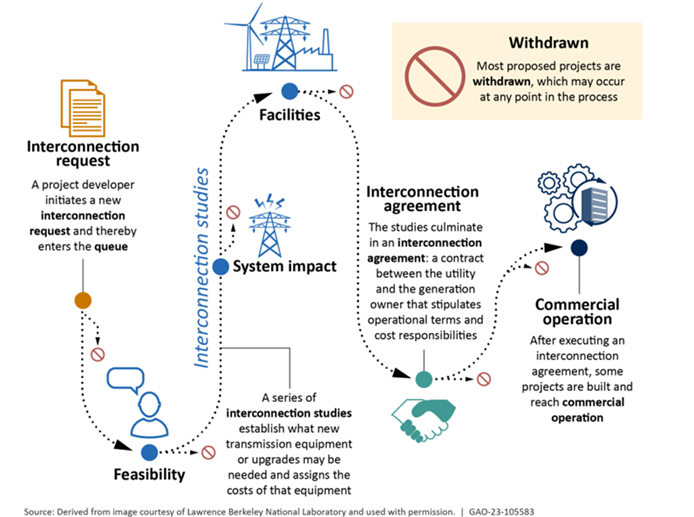

Each project in the queue must adhere to a set of interconnection rules and undergo a comprehensive, multi-step process that includes multiple studies to evaluate potential impacts on the grid. Below is a simplified diagram developed by the Government Accountability Office:[vi]

In short, the high volume of new requests by renewables has overwhelmed existing interconnection processes. Regulators and grid operators have implemented numerous reforms to the interconnection queue process, including but not limited to this year’s FERC order 1920, which includes requirements to consider future interconnection needs proactively. However, a recent Grid Strategies and Brattle Group report indicates that existing reforms will not fix the bottleneck.[vii] Echoing these sentiments, FirstEnergy’s CEO, Brian Tierney, said, “If people were to respond to yesterday’s [capacity auction results] and say, yes, I think it’s a good idea to invest in baseload dispatchable generation PJM, it would be six years before that capacity would come online.”[viii]

CONCLUSION

Peak demand is poised to spike by 91 GW over the next ten years[ix], with 38 GW of that growth occurring over the next five years.[x] With over 44 GW of coal capacity expected to retire by 2028, interconnection queues offer little relief for resource adequacy challenges facing the grid. (Expected coal retirements do not take into account a number of EPA regulations designed to eliminate most, if not all, of the coal fleet.) Utilities, grid operators, and policymakers, especially state utility commissioners, should focus on retaining existing generation capacity, including reliable, dispatchable coal power plants.

[i] Lawrence Berkeley National Laboratory. “Queued Up: Characteristics of Power Plants Seeking Transmission Interconnection.” April 2024.

[ii] Ibid.

[iii] Ibid.

[iv] Ibid.

[v] S&P Global. 2024 US Interconnection Queues Analysis. May 2024. This analysis examined the time between when a project entered the queue and its proposed online date.

[vi] United States Government Accountability Office. Technology Assessment, Utility-Scale Energy Storage, Technologies and Challenges for an Evolving Grid. March 2023.

[vii] Grid Strategies, The Brattle Group. Unlocking America’s Energy, How to Efficiently Connect New Generation to the Grid. August 2024.

[viii] Seeking Alpha. “FirstEnergy Corp. (FE) Q2 2024 Earnings Call Transcript.” July 31, 2024.

[ix] NERC. Long-Term Reliability Assessment. December 2023.

[x] Grid Strategies. The Era Of Flat Power Demand Is Over. December 2023.