Warnings about a pending grid reliability crisis are increasing, and fingers point to the premature retirement of dispatchable electricity resources as the primary threat. As FERC Commissioner Mark Christie commented a few days ago, the problem is not necessarily the addition of wind and solar to the grid, but rather the retirement of dispatchable resources such as coal and natural gas.[i] Christie asked rhetorically, “Are the lights going to stay on?” The answer is that no one knows for sure and that’s very troubling.

Despite serious warnings extending back to at least 2019, nothing meaningful has been done yet to head off the crisis.[ii] In fact, the situation is becoming worse because not only are an alarming number of coal power plants retiring but they are retiring at a faster pace than many people realize.

America’s Power tracks the status of coal plant retirements that have been announced by plant owners. These future retirements are based primarily on integrated resource plans filed with utility commissions and public statements by the owners of coal plants. At the same time, we recognize that announced retirement dates are subject to change. Nonetheless, announced coal retirements still provide an indication of the scale and possible timing of retirements and, thus, their potential impacts on grid reliability.

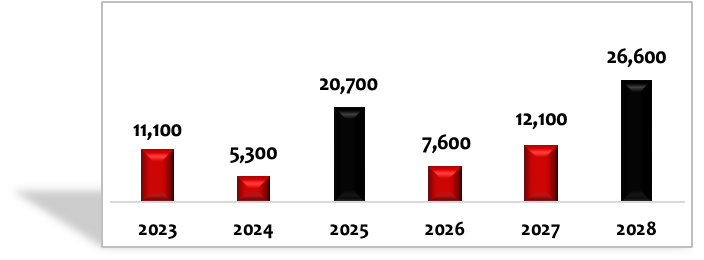

Typically, attention tends to be focused on retirements that will occur over a relatively long time horizon, for example, 2030 or later. Announced coal retirements, as of August, totaled 91,600 megawatts (MW) during the 8-year period 2023-2030.[iii] However, the 4-year period 2023-2026 and 6-year period 2023-2028 merit even more attention because of the lack of time to mitigate reliability challenges – such as adding dispatchable replacement capacity – if these retirements happen as announced. Announced coal retirements total 44,700 MW over the next 4 years and 83,400 MW during the next 6 years.

Utilities have announced plans to convert 13,500 MW of retiring coal capacity to natural gas during 2023-2028, so the net loss of dispatchable capacity would be approximately 69,900 MW (83,400 MW minus 13,500 MW) during the next 6 years. However, reliance on natural gas carries well-known risks, such as supply interruptions and price volatility. The following table shows announced coal retirements and gas conversions for the U.S. coal fleet during the next 6 years.

| Retirements (MW) | Retirements Converting (MW) | |

| 2023 | 11,100 | 200 |

| 2024 | 5,300 | 2,300 |

| 2025 | 20,700 | 5,500 |

| 2026 | 7,600 | 900 |

| 2027 | 12,100 | 2,100 |

| 2028 | 26,600 | 2,500 |

| TOTAL | 83,400 | 13,500 |

The graph below shows the same data (without conversions) which makes it easier to see the dramatic rise in announced coal retirements in 2025 and 2028 (black).

MISO, PJM and SPP have the largest coal fleets among the ISO/RTOs. Approximately 60 percent of the nation’s entire coal fleet operates within these three regions. MISO and SPP also happen to be regions that are at risk of capacity shortages, according to the North American Electric Reliability Corporation (NERC). The table below shows coal capacity (MW) last year and announced coal retirements and conversions to natural gas during 2023-2028.

| Coal Capacity 2022 | Coal Retirements 2023-2028 | Retirements Converting 2023-2028 | |

| MISO | 49,400 | 25,600 | 3,300 |

| PJM | 43,900 | 21,100 | 3,400 |

| SPP | 20,800 | 6,000 | 1,400 |

| TOTAL | 114,100 | 52,700 | 8,100 |

These announced retirements mean that MISO and PJM could lose roughly half their existing coal fleets within the next 6 years, and SPP could lose 30 percent of its coal fleet. To make matters worse, these national and regional figures do not include coal retirements that will be caused by EPA regulations such as the agency’s Good Neighbor Rule and proposed Carbon Rule.[iv]

We hope that drawing more attention to the pace, not just amount, of retiring coal capacity in the near term will lead FERC, NERC, ISO/RTOs, utility commissioners and EPA to take steps to avoid, or at least minimize, more coal retirements until –

- Sufficient replacement capacity can be added to the grid, taking into account the relative capacity values of different resources. Replacing one MW of dispatchable resources with one MW of intermittent resources is not adequate to maintain reliability because of the lower capacity values of renewables.

- The reliability impacts of EPA regulations are analyzed and mitigated before regulations are finalized and implemented. FERC is scheduled to hold a technical conference in November to discuss the reliability impacts of EPA’s carbon rule. This is at least a step in the right direction. However, EPA should be required to work closely with FERC, the Department of Energy, ISO/RTOs and stakeholders to analyze the reliability impacts of its proposed and final rules and explain how these impacts are being mitigated.

- ISO/RTOs identify all resource attributes that are necessary for grid reliability and compensate the providers of those attributes. This needs to be done on an expedited schedule.

Last, more than 80 percent of the nation’s coal fleet is subject to the oversight of some sort of regulatory body, with 60 percent overseen by state utility commissions. We urge utility commissions and other regulatory bodies to pause coal retirements at least until the three steps above can be completed.

[i] RTO Insider, “Nation’s Grid Faces Rendezvous with Reality,” September 11, 2023.

[ii] See, for example, NERC’s “2019 Long-Term Reliability Assessment,” page 19: “Operating Reliability Risks Due to Conventional Generation.”

[iii] We use nameplate capacities rounded to the nearest 100 MW in this paper.

[iv] EPA is implementing, has finalized or has proposed six rules that impact the coal fleet: Coal Combustion Residuals (being implemented), revised Effluent Limitations Guidelines (proposed), revised Mercury and Air Toxics Standards (proposed), Good Neighbor Rule (finalized), Carbon Rule (proposed) and Regional Haze (being implemented).