Submitted June 21, 2022

Comments on EPA’s Proposed Federal Implementation Plan Addressing Regional Ozone Transport for the 2015 Ozone National Ambient Air Quality Standard

EPA ID No. EPA-HQ OAR-2021-0668

America’s Power submits these comments on EPA’s proposal to address regional transport of ozone.1 America’s Power is a national trade association whose members engage in coal-fired electricity generation, coal production, transportation, and equipment manufacturing. Coal-fired generation is an essential part of the nation’s electricity mix because it is reliable, resilient, affordable, fuel secure, promotes energy security, and provides optionality. At the same time, we support an all-the-above energy strategy that takes advantage of all resources, including fossil fuels, nuclear power and renewable energy.

EPA’s proposal will increase the stringency of NOx control requirements and expand the geographic scope of the existing Cross-State Air Pollution Rule (CSAPR) in order to attain the national ambient air quality standards for ozone. The agency’s Regulatory Impact Analysis (RIA) projects that annualized costs of the proposal could be as much as $1.5 billion.2 In 2027 alone, compliance costs are projected to be $1.955 billion. In addition, EPA projects the proposal will cause 23,000 megawatts (MW) of coal retirements − more than 10 percent of the existing coal fleet − within the next three years.3 However, EPA has provided no analysis of the reliability impacts of retiring such a large amount of coal- fired generating capacity within such a short period of time. Also, the retirement of coal- fired generating capacity contributes to inflationary pressures by reducing the flexibility to switch fuels when natural gas prices rise for power generation and other uses.

Because we support reasonable and affordable measures to achieve compliance with the national ambient air quality standards for ozone, we cannot support the proposal because of its costs, detrimental impacts on the coal fleet, and its potential threat to the reliability of the electricity grid.

“We are heading for a reliability crisis,” in part, because of coal retirements.

In May, FERC Commissioner Mark Christie warned, “We are heading for a reliability crisis… The nation’s grid reliability is deteriorating because the nation’s utilities are switching too rapidly from baseload power plants to intermittent renewables.”4 Baseload refers to coal, gas and nuclear power plants.

The same month, NERC issued its “2022 Summer Reliability Assessment” which warned that the reliability of the grid in roughly two-thirds of the U.S. is at risk this summer due to potential shortages of electric generating capacity and the effects of extreme weather.5 NERC pointed to an “elevated” risk of “insufficient operating reserves” as a result of extreme demand in western states, especially California and Texas. NERC has issued similar warnings before. According to a NERC official, “The nation’s grid reliability is deteriorating.”6 As far back as 2018, NERC warned that accelerated retirement of thermal generation (coal, nuclear and gas) could lead to power outages.

A month before the NERC report was issued, the Midcontinent Independent System Operator (MISO) issued a warning that 11 of the states comprising its 15-state region face an increased risk of “temporary, controlled load sheds.”7 This means there is a greater chance this summer that the citizens of Iowa, Illinois, Indiana, Kentucky, Michigan, Minnesota, Missouri, Montana, North Dakota, South Dakota, and Wisconsin could experience temporary blackouts. MISO attributed this heightened risk to “thermal retirements and the increasing transition to renewables.”

Some 18,300 megawatts (MW) of MISO’s coal-fired capacity have retired since 2015. These coal retirements are the primary reason that MISO’s accredited generating capacity has declined to such an extent that the grid operator may be forced to order temporary electricity blackouts this summer. (The accredited capacity of coal is almost six times greater than the accredited capacity of wind.) MISO summed up its reliability problem this way: “Although installed capacity has increased in the last five years, accredited capacity has decreased due to thermal retirements and the increasing transition to renewables.”

However, the problem facing MISO is likely to become even more serious because announced coal retirements total 17,000 MW during 2022-2025 and more than 27,000 MW by 2030. If all of MISO’s retiring coal was replaced hypothetically with wind, close to 160,000 MW of installed wind capacity would have to be added by 2030 to provide the same reliability assurance as the 27,000 MW of retiring coal capacity. (Currently, MISO has less than 27,000 MW of wind capacity.)

Similarly, the Electric Reliability Council of Texas (ERCOT) has also issued warnings of potential electric shortages in Texas, where tight supplies have already led to conservation measures due to high electricity demand. Coal retirements in ERCOT totaled 6,300 MW during 2018-2020.

The Wall Street Journal has warned that the nation’s grid is “increasingly unreliable.”8 Major sustained electricity outages in the U.S. increased from “fewer than two dozen” in 2000 to more than 180 in 2020. The average utility customer experienced just over 8 hours of power failure in 2020, more than double the length of outages in 2013.

EPA rules will exacerbate coal retirements and increase the threat to grid reliability.

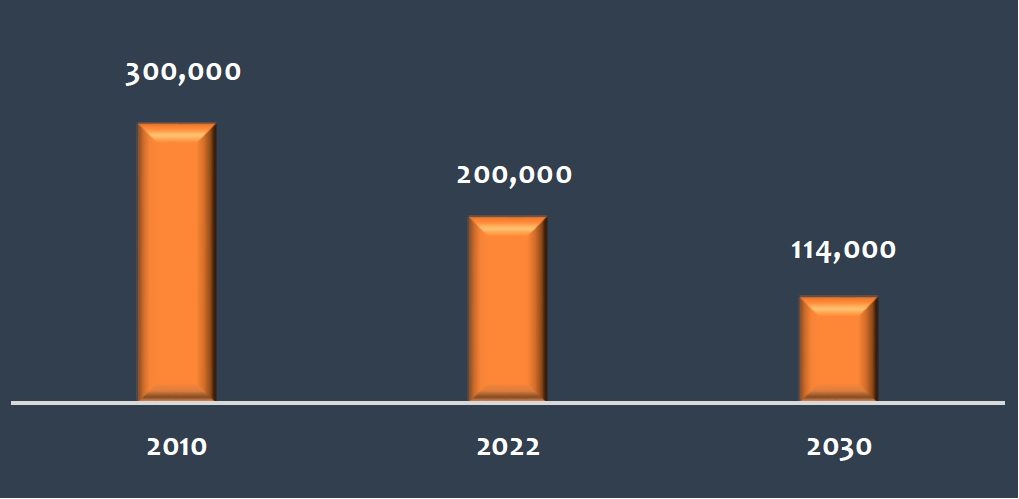

The U.S. coal fleet totals slightly more than 200,000 MW today, a decline of roughly 100,000 MW over the past decade. Most of these retirements (more than 86,000 MW) have happened since 2015. EPA regulations, especially the Mercury and Air Toxics Standards rule, were either the cause or a contributing factor in most instances.

Over the next nine years (2022-2030), announced coal retirements total slightly more than 86,000 MW. The bulk (more than 51,000 MW) of these announced retirements are located within the footprints of PJM and MISO. Together, these two grid operators span all or parts of 26 states. Last year, coal generated 22 percent of the electricity in PJM and 40 percent in MISO. However, the coal fleets in both regions will decline by half from by 2030 even without taking into account this proposed rule or other EPA rules that are virtually certain to cause more coal retirements.

U.S. coal fleet (MW)

(2030 capacity does not reflect impacts of the proposed transport rule or future EPA rules)

EPA projects that the proposed transport rule will cause 23,000 MW of coal retirements by 2030. (These coal retirements are not reflected in the chart above which is based strictly on announced retirements, not projections.) Hypothetically replacing these EPA- caused coal retirements would require the construction by 2025 of 133,000 MW of wind power or 46,000 MW of solar power based on MISO’s accredited capacity values.9

Other rules, such as the following, are all but certain to cause even more coal retirements:

- Coal combustion residuals rule;

- Effluent limitations guidelines rule (current and revised);

- Regional haze rule;

- Replacement for the Affordable Clean Energy rule;

- Revised Mercury and Air Toxics Standards rule; and

- Implementation of more stringent PM2.5 and ozone standards.

For example, coal capacity at risk of retirement includes capacity that could be required to install the most expensive emissions control equipment, especially selective catalytic reduction (SCR) to reduce NOx emissions and flue gas desulfurization (FGD) to reduce SO2 emissions. More than 82,000 MW of coal-fired capacity currently lack SCR and more than 37,000 MW lack FGD. Although exact impacts are unclear at this time, the EPA rules listed above are likely to cause substantial retirements of coal capacity, particularly in the 2026-2028 timeframe, based on our estimates for compliance with these rules.

We urge EPA to work closely with reliability authorities, especially ISO/RTOs and the North American Electric Reliability Corporation (NERC), to prevent its rules from causing

reliability problems due to premature coal retirements and idling of coal-fired generation.

The proposal places unnecessary restrictions on emissions trading.

EPA is proposing to increase the stringency and expand the scope of the existing transport rule by requiring all affected coal and gas electric generating units in 25 states to upgrade their NOx controls by 2023 and effectively requiring the installation of SCR by 2026 on coal units that do not already have SCR. EPA’s technical support document for the proposed rule indicates that SCR retrofits for a coal unit average $151 million to

$160 million.10

The proposed rule would achieve NOx emission reductions through an emissions trading program. Although based on the trading scheme developed for the existing transport rule, the NOx emissions trading program proposed for the updated rule includes new requirements that limit the flexibility and increase the compliance costs of NOx reductions. These proposed requirements include a “backstop” NOx daily emissions limit, an annual recalibration requirement for banked allowances, and a secondary NOx limit for each unit. These inflexible requirements will increase compliance costs and could cause idling of coal units during the summer when electricity demand typically spikes. Therefore, we urge EPA to eliminate the proposed trading restrictions.

• Eliminate the Backstop Emissions Rate.

In addition to establishing stringent NOx emissions budgets, the proposal would impose a backstop daily NOx emissions limit of 0.14 lb/MMBtu for coal-fired units of 100 MW and larger.11 For a coal-fired unit that exceeds the backstop limit on any day, all NOx emissions from the unit on that day that exceed the limit will be subject to a 3-for-1 allowance surrender ratio instead of the normal 1-for-1 ratio.

The increased allowance costs (or even the unavailability of allowances) could make it virtually impossible to continue operating coal-fired generation without installing SCR. In addition to significantly increasing compliance costs, imposing this allowance penalty could force the idling of coal-fired generation during peak summer demand periods if they are unable to obtain additional NOx allowances due to emissions trading constraints. As discussed below, those constraints include curtailing the banking of unused allowances.

The higher NOx allowance surrender requirement will even penalize coal-fired generation that has SCR in cases when units must operate above the backstop limit due to malfunctions or other problems. It makes no sense to penalize coal-fired generation that has installed SCR but is unable to meet the backstop limit due to unforeseen and uncontrollable circumstances. Again, additional compliance costs could force the shutdown or idling of coal-fired generation and, as a result, exacerbate the electricity grid reliability risks already facing the power sector.12

• Eliminate the Limits on Unused NOx Allowances.

The proposal would establish an annual recalibration process for banked NOx allowances starting in 2024. Under the proposed recalibration process, EPA would reduce each year the total quantity of unused, banked NOx allowances held in all allowance accounts to only 10.5 percent of the state NOx emission budgets for the current control period.13 This

annual recalibration requirement would have several adverse impacts on coal-fired generation.

First, the recalibration requirement could disincentivize early excess NOx emission reductions through cost-effective control measures, including maximizing NOx removal levels achieved by SCR and other emission control measures.14 If banked allowances are simply eliminated every year, utilities may take a use-or-lose approach because a substantial portion of their unused allowances would be worthless.

Second, the proposed requirement to limit the total amount of banked allowances each year also could have adverse reliability impacts by forcing the idling of coal generation during periods of peak electricity demand. These impacts could occur because the proposed limit on banked allowances could substantially reduce the number of surplus allowances to cover NOx emission increases caused by spikes in electricity demand. If a coal-fired generator cannot secure a sufficient number of banked allowances to cover increased emissions due to peak electricity demand, the only two options would be to idle the unit or continue to run the unit and be subject to an enforcement action.15

Third, the reduction in banked allowances will make it more difficult, i f not impossible, to operate a coal-fired unit without an SCR. For example, a tight NOx allowance market could effectively preclude electric utilities from complying by purchasing NOx allowances instead of installing SCR. The elimination of this alternative compliance option means that even coal-fired units equipped with selective non-catalytic reduction (SNCR) systems or other NOx control systems may not have the option to cover any allowance shortfall by purchasing allowances. Because the installation of SCR will likely be cost prohibitive for many coal units, a utility may have no choice but to retire a coal-fired power plant if its only compliance option is to install SCR.

• Eliminate the Secondary NOx Emissions Limit.

A third emissions trading constraint is the “secondary” NOx emissions limit that would apply to each unit.16 The secondary NOx emission limit would be set based on the “benchmark seasonal NOx emissions rate” for a unit.17

In effect, the secondary NOx emission limit would impose a unit-specific requirement that could significantly reduce the flexibility of the emissions trading program by prohibiting each coal-fired unit from exceeding its benchmark seasonal average NOx emissions rate. Any coal unit exceeding its secondary NOx emission limit could trigger an EPA enforcement action.

America’s Power opposes a secondary NOx emissions limit because it layers on top of the emissions trading program an inflexible requirement that is unnecessary for remedying ozone nonattainment problems in downwind states.

Furthermore, this inflexible emissions limit is redundant to the transport rule assurance provisions that are already intended to limit the degree to which a state could rely on purchased allowances from other states as a substitute for its in-state emission reductions. In particular, the current CSAPR assurance provisions already place significant constraints on the use of surplus NOx allowances in cases where a state is overly reliant on out-of-state allowances for meeting its in-state requirements. In such cases, an additional two NOx allowances (for a total of three allowances) must be surrendered for each ton of NOx emissions above a state’s assurance levels. EPA has

already set each state’s assurance level based on the NOx emission reductions that are sufficient to remedy its contribution to downwind ozone nonattainment problems in other states. As a result, the CSAPR assurance provisions already establish a regulatory requirement that limits the degree to which a state could rely on purchased allowances from other states.

Conclusion

Organizations responsible for grid reliability are concerned about the retirement of coal- fired generation because retirements are leading to projected capacity shortages and the potential for blackouts in many parts of the country. Eliminating the restrictions EPA has proposed for the NOx emissions trading program would help to reduce at least some of the pressure for coal units to retire prematurely. However, we are very concerned about the impacts of other EPA rules on the nation’s coal fleet and the reliability of the electricity grid.

Sincerely,

Michelle Bloodworth President and CEO America’s Power

1 Federal Implementation Plan Addressing Regional Ozone Transport for the 2015 Ozone National Ambient Air Quality Standard, 87 Fed. Reg. 20036 (April 6, 2022).

2 Regulatory Impact Analysis for Proposed Federal Implementation Plan Addressing Regional Ozone Transport for the 2015 Ozone National Ambient Air Quality Standard , EPA-452/D-22-001, February 2022. 3 The RIA includes two different projections for coal retirements: 18,000 MW by 2030 (page 4-18) and 23,000 MW by 2025 (Table 4-14). These seem to be irreconcilable discrepancies, so we use the higher projection because utilities will anticipate upcoming EPA rules and preemptively retire coal units rather than installing NOx controls which would become stranded investments.

4 NERC, 2022 Summer Reliability Assessment, May 2022.

5 Remarks by Commissioner Mark Christie at FERC public meeting on May 19, 2022.

6 Remarks to trade press by John Moura, NERC Director of Reliability Assessment and Performance Analysis, May 20, 2022.

7 MISO, 2022/2023 Planning Resource Auction (PRA) Results, April 14, 2022.

8 Wall Street Journal, America’s Power Grid Is Increasingly Unreliable, Katherine Blunt, February 18, 2022.

9 The dependability of electricity resources varies. A less dependable resource has a lower accredited capacity value than a more dependable resource. MISO’s average accredited capacity value for wind for 2022-2023 is 15.5 percent of installed capacity, which means that 100 MW of installed wind capacity can be expected to generate 15.5 MW of power at times of peak electricity demand. MISO’s accredited capacity value for solar is 50 percent of installed capacity for its first year of operation. Longer term, MISO expects to adopt 20 percent as the average accredited capacity value for solar. Coal-fired generation is a more dependable resource. Over the years, MISO has assumed coal generation has capacity values ranging from slightly less than 90 percent to a little more than 95

percent of installed capacity. This means that MISO assumes that 100 MW of installed coal-fired generating capacity can be counted on to generate 90-95 MW of power when electricity demand peaks.

10 EPA, EGU NOx Mitigation Strategies Proposed Rule TSD, February 2022.

11 The daily NOx limit would first apply in 2024 to coal-fired units operating with SCR controls and then be extended in 2027 to apply to coal-fired units that have not installed SCR controls.

12 For these reasons, EPA should exclude NOx emissions during startup, shutdown, and malfunction (SSM) periods for determining compliance with the backstop NOx emission limit if the Agency decides to impose a backstop in the final rule. SCR controls cannot operate during the SSM periods and, as a result, coal-fired units will be unable to comply with the backstop limit during these SSM periods. Furthermore, the final rule should clarify that the increased 3 -to-1 allowance surrender requirement applies only to the portion of the NOx emissions that exceeds the backstop limit and not all of the NOx emissions during the day.

13 According to EPA, the annual recalibration process would involve “identifying the ratio of the target bank amount to the total quantify of banked allowances held in all accounts before the conversion and then, if the ratio was less than 1.0, multiplying the quantity of banked allowances held in each account by the ratio to identify the appropriate recalibrated amount for the account … and deducting any allowances in the account exceeding the recalibrated amount.”

14 NOx control options include maximizing the removal efficiency of combustion controls and SNCR. 15 The only other option to avoid enforcement would be for the operator to obtain a Section 202(c) order pursuant to the Federal Power Act. Such extraordinary relief, however, is not necessarily guaranteed and requires considerable resources and coordination.

16 An affected unit would be subject to the secondary NOx emission limit in situations “where a state’s assurance level for a control period has been exceeded” by relying on the use of out-of-state allowances for meeting its in-state NOx control requirements.

17 EPA is proposing to set each unit’s benchmark seasonal average NOx emissions rate as “the higher of (1) 0.10 lb/MMBtu or (2) 125 percent of the unit’s lowest seasonal average NOx emissions rate in a previous control period” during which the unit operated for at least 10 percent of the hours.